February 2025 – Manager Commentary

“We continue to work tirelessly on a satisfactory resolution to the Bridge Taxi Finance impasse. Progress has been made on changing the service provider and progress is being made on changing the debt arranger and restructuring the debt. We confidently expect the Retention Fund to make a modest distribution at the end of March 2025.”

January 2025 – Manager Commentary

“During the holiday period, we made further progress on restructuring loans in which the ultimate borrower is Bridge Taxi Finance. One of those loans, with the JSE code RED706, did make a partial payment of interest on 17th January 2025, leading to a one-month return for the Retention Fund of +0.18%.”

January 2025 – Update on the MiPlan IP Enhanced Income Retention Fund

Bridge Taxi Finance update

As you may be aware, some investors hold interests in the main fund and in the retention fund of the Mi-Plan Enhanced Income Fund. Together these are the consolidated fund. The retention fund houses instruments that are exposed to Bridge Taxi Finance. While the main fund achieved top quartile performance over periods from 3 years to 10 years, understandably there has been on-going investor concern about the likely value of exposure in the retention fund.

Since the formation of the retention fund in early 2024, Vunani Fund Managers has been intensively engaged in trying to resolve the issues at Bridge Taxi Finance that impact the instruments in the retention fund. As part of this effort, Vunani Fund Managers along with other Noteholders, unanimously approved the delisting and restructuring of the notes exposed to Bridge Taxi Finance in December 2024. The legal agreements to restructure the instruments will proceed during the course of the first quarter of 2025.

The delisting is aimed at improving the transparency of information shared between the new Servicer — being Mobalyz — and Noteholders as the ultimate capital providers. Previously this information had been subject to assessment for price sensitivity under JSE debt listing rules. Furthermore, swifter information exchange will enable Noteholders to have greater impact in terms of steering Mobalyz to execute certain interventions to increase collection levels.

All these initiatives are on-going and we believe that they will bear fruit. However, it is important to point out to investors that at the end of December 2024, leadership of the Management Company along with the Trustees of the collective investment scheme made a decision to fully write down a subordinated note. Vunani Fund Managers categorically expressed its disagreement with this stance.

Vunani Fund Managers remains resolute in our unwavering commitment to recover funds owed for all instruments and to realise maximum value for our clients within the shortest amount of time.

Rowan Williams-Short

Vunani Fund Managers

December 2024 – Manager Commentary & update on the MiPlan IP Enhanced Income Retention Fund

“During the final quarter of 2024, Noteholders met to discuss delisting the various notes exposed to Bridge Taxi Finance. A unanimous vote was taken to delist, which is awaiting ratification by the JSE. The delisting will create a conducive environment for information flow which will be helpful during the restructuring process.

We anticipate that new structures will allow all Noteholders stronger decision-making rights which will in turn aid initiatives to improve cash collections and return cash to investors. At the end of the quarter, leadership of the Management Company and the Trustees decided to fully impair the subordinated note RED707.”

December 2024 – Red 707 valuation update

After extensive consultation between the Trustees, BCI / IP Management Company, it was resolved by them to write down the valuation of the subordinated debt instrument RED707 to a nil carrying value. To be clear: it is only the RED707 that is being revalued, not every instrument in the retention fund.

While no trading is possible in the MiPlan IP Enhanced Income Retention Fund units, the carrying value is important for other unit trust funds and fund of funds to continue to ensure their assets are fairly valued as required by the Regulator.

This step has been taken to ensure all investors are treated fairly, as far as possible, under the circumstances.

Regards

Anton Turpin

November 2024 – Manager Commentary

“We remain intensively engaged on the Bridge Taxi Finance issue. The change of service provider from Mokoro to Mobalyz (entailing the physical movement of vehicles and the hand over of the collections book) has been completed. Having removed what had become a somewhat dysfunctional operating company, the next step is to review our agreements with the debt arranger. This is currently in progress.”

October 2024 – Manager Commentary

“The change of service provider from Mokoro to Mobalyz (entailing the physical movement of vehicles and the handover of the collections book) has been completed. The task befalling Mobalyz is principally to improve the collections rate. Various initiatives are in place.”

September 2024 – Manager Commentary

“We and other investors have changed service providers from BTF to Mobalyz. This entailed moving ISAs and physical, repossessed taxis, a process that took a few weeks. Mobalyz also collects monthly payments on behalf of SA Taxi and those collection rates are considerably higher than what BTF had been achieving. Some interest was received in September, so the fund returned 0.5%.”

August 2024 – Manager Commentary

“We remain intensively engaged on the Bridge Taxi Finance issue. The replacement of the servicing agent (from Mokoro to Mobalyz) has gone smoothly and early results on collections and sales appear promising.

The business rescue practitioner at Mokoro has come to the view that the business cannot be rescued. He has therefore started preparing an application to liquidate Mokoro. The liquidation hearing is likely to take place during the course of this month, depending on when the court is ready to hear the application. In the meantime, the bulk of the assets that were at Mokoro are now at Mobalyz and efforts to collect on the outstanding debts continue there.”

Update: 17 September 2024

“During September 2024, further progress was made on the fund’s investments associated with Bridge Taxi Finance.

First, noteholders voted unanimously not to extend the maturity of the Martius note with JSE code MAR02B, scheduled to mature on 17th September 2024. Legally, this places the notes in default. The default crystallizes investors’ claims against both the funding SPV and the previous service provider, Mokoro.

Second, we received partial coupon payments on both MAR02B and MAR03B on 17th September. While these are well below the originally promised payments, they are the first interest payments since January 2024.

Third, the default allows us, along with other noteholders, to begin restructuring the Martius and Redink notes.”

July 2024 – Manager Commentary

“We remain intensively engaged on the Bridge Taxi Finance issue. We have changed the servicing agent, responsible for collections and repossessions. Negotiating with other lenders, expert intermediaries and the underlying companies can be frustratingly slow (the Land Bank default has now endured over 4 years) but progress is being made. We have begun exploring a new initiative. As the relevant instruments are listed on the JSE we cannot divulge sensitive information at this stage.”

June 2024 – Manager Commentary

“We remain intensively engaged on the Bridge Taxi Finance issue. We have decided to change the servicing agent, responsible for collections and repossessions. Negotiating with other lenders, expert intermediaries and the underlying companies can be frustratingly slow (the Land Bank default has now endured over 4 years) but progress is being made.”

May 2024 – Manager Commentary

“We remain intensively engaged on the Bridge Taxi Finance issue. Not all lenders agreed to work together on this, but most have given assent. Various measures were put in place towards improving collections, cutting costs at the operating company’s level, testing the efficacy of an outsourced collections agency, increasing throughput at the refurbishment plant and releasing new vehicles currently held at a secure facility in Durban.

Nevertheless, the operating company remains under pressure from a liquidity perspective. A Noteholders’ meeting in May, failed to pass resolutions that would release general management fees to the operating company from funds held in the ring-fenced special purpose vehicles under the control of the Noteholders. However, temporary funding for critical expenses was allowed. We have continued to engage with other Noteholders to further isolate the interests of the Noteholders from the problems at the operating company, which have included engaging legal, verification and valuation advisors. The aim remains to maximise recoveries for investors.”

April 2024 – Manager Commentary

“We remain intensively engaged on the Bridge Taxi Finance issue. Not all lenders agreed to work together on this, but most have given assent. Various measures are in place towards improving collections, cutting costs at the operating company’s level, testing the efficacy of an outsourced collections agency, increasing throughput at the refurbishment plant and releasing new vehicles currently held at a secure facility in Durban.”

March 2024 – Manager Commentary

“This retention fund principally consists of assets with exposure to two special purpose vehicles linked to Bridge Taxi Finance No. 8 (RF) (Pty) Ltd (“BTF 8”) and Bridge Taxi Finance No. 6 (RF) (Pty) Ltd (“BTF 6”). Debt notes have been issued under the Redink programme for BTF 6 and under the Martius programme for BTF 8. These notes referencing BTF 6 and BTF8 have performed as expected since the initial investments in June 2018, paying all coupons in full and on time each quarter.

However, in January 2024, the founder, CEO and largest shareholder of Bridge Taxi Finance and its operating company, Mokoro Holdings, passed away suddenly. Subsequently, Vunani Fund Managers discovered that Mokoro had overdue payments to suppliers and that there had been an underpayment of interest due in a structure outside of either Martius or Redink. These failures caused an “Event of Default”. Upon further investigation, it became apparent cash collections had deteriorated significantly and consequently the likelihood of missed coupon payments had increased. In this light, Vunani Fund Managers took the difficult decision to create a retention fund (also commonly known as a “side-pocket”), to house the affected instruments and prudently assume impairments on the carrying value of the affected instruments based on seniority and priority of claims. Management fees on the side-pocket have been suspended.

Vunani Fund Managers has appointed White and Case, a legal firm with extensive expertise in debt finance and structured finance, to advise on the legal rights and remedies available to the lenders in BTF 6 and Martius programme for BTF 8. Other service providers are being engaged to ensure that there is clarity on the valuation and security of underlying assets. Vunani Fund Managers remains in continuous engagement with the operational management of Bridge Taxi Finance, to ensure funds invested in the affected instruments are protected and recovered to the greatest extent possible. Vunani Fund Managers undertakes to inform clients of any significant developments in relation to this matter. That notwithstanding, a firm timeline for the resolution of this matter is uncertain but will be shared as and when there is further clarity.”

March 2024 – Manager Commentary

“This retention fund principally consists of assets with exposure to two special purpose vehicles linked to Bridge Taxi Finance No. 8 (RF) (Pty) Ltd (“BTF 8”) and Bridge Taxi Finance No. 6 (RF) (Pty) Ltd (“BTF 6”). Debt notes have been issued under the Redink programme for BTF 6 and under the Martius programme for BTF 8. These notes referencing BTF 6 and BTF8 have performed as expected since the initial investments in June 2018, paying all coupons in full and on time each quarter.

However, in January 2024, the founder, CEO and largest shareholder of Bridge Taxi Finance and its operating company, Mokoro Holdings, passed away suddenly. Subsequently, Vunani Fund Managers discovered that Mokoro had overdue payments to suppliers and that there had been an underpayment of interest due in a structure outside of either Martius or Redink. These failures caused an “Event of Default”. Upon further investigation, it became apparent cash collections had deteriorated significantly and consequently the likelihood of missed coupon payments had increased. In this light, Vunani Fund Managers took the difficult decision to create a retention fund (also commonly known as a “side-pocket”), to house the affected instruments and prudently assume impairments on the carrying value of the affected instruments based on seniority and priority of claims. Management fees on the side-pocket have been suspended.

Vunani Fund Managers has appointed White and Case, a legal firm with extensive expertise in debt finance and structured finance, to advise on the legal rights and remedies available to the lenders in BTF 6 and Martius programme for BTF 8. Other service providers are being engaged to ensure that there is clarity on the valuation and security of underlying assets. Vunani Fund Managers remains in continuous engagement with the operational management of Bridge Taxi Finance, to ensure funds invested in the affected instruments are protected and recovered to the greatest extent possible. Vunani Fund Managers undertakes to inform clients of any significant developments in relation to this matter. That notwithstanding, a firm timeline for the resolution of this matter is uncertain but will be shared as and when there is further clarity.”

March 2024 – Retention Fund Update

Update on Retention Fund – Non-payment of the interest coupon on the Martius notes.

Further to our previous notifications, updates and communications, investors in the MiPlan IP Enhanced Income Retention Fund are notified that Martius (RF) Limited issued a further SENS Cautionary Announcement today, Wednesday, 13 March 2024, confirming that no interest will be paid on the Martius MAR02B and MAR03B notes as at the next coupon date, being 17 March 2024. Further to the above, please find below the communique from the investment manager, Vunani Fund Managers. Please note that this non-payment does not affect the value of the assets in or the pricing of the MiPlan IP Enhanced Income Fund. This notice is issued in terms of and in compliance with the conditions prescribed by the Financial Sector Conduct Authority in approving the side-pocketing on the assets in the MiPlan IP Enhanced Income Retention Fund.

Re: SENS announcement relating to Martius instruments

We make reference to the SENS announcement released earlier today pertaining to the default on the Martius B (RF) Limited (“Martius B“) Note Programme, specifically the instruments MAR02B and MAR03B. As communicated previously, a Retention Fund / side-pocket was created on 16 February 2024 to house the four instruments in the MiPlan Enhanced Income Fund exposed to two special purpose vehicles linked to Bridge Taxi Finance No. 8 (RF) (Pty) Ltd (“BTF 8”) and Bridge Taxi Finance No. 6 (RF) (Pty) Ltd (“BTF 6”). The Martius B notes reference BTF 8. A decision was taken in February to suspend interest accruals on the respective instruments in client portfolios and only accrue for coupons upon receipt. On 1 March 2024, we communicated the decision to reduce the carrying value of MAR02B and MAR03B by 30% each. We remain committed to keeping our clients informed of any significant developments in the resolution of this matter.

13 March 2024

Vunani Fund Managers

February 2024 – Retention Fund Update

Notification Of Impairment Of Side-Pocketed Assets

Investors in the MiPlan IP Enhanced Income Retention Fund are notified that Vunani Fund Managers have decided to decrease the fair value of the side-pocketed Redink and Martius instruments in the Retention Fund. The notification from Vunani Fund Managers is set out below, which includes the rationale for and extent of the impairments. Following consultations with the Trustee and the Administrators, the impairments will be with effect from Friday, 1 March 2024. Please note that these impairments do not affect the value of the assets in or the pricing of the MiPlan IP Enhanced Income Fund. This notice is issued in terms of and in compliance with the conditions prescribed by the Financial Sector Conduct Authority in approving the side-pocketing on the above side-pocketed assets.

27 February 2024

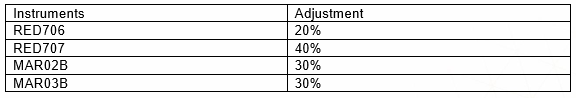

Notification of Impairment of RedInc and Martius instruments

Vunani Fund Managers has had extensive engagements over the past few weeks with both the issuer (RedInc) and the management of the Service agent (Mokoro) regarding the two SPV structures in which the below notes reside. Despite the SPVs performing satisfactorily, financial distress at the service provider level has led to subpar collections. Unfortunately, legal restrictions prevent the issuer from providing us with the detailed data needed for a comprehensive valuation. Based on the available information, including direct engagements and other correspondence, and our best efforts assessment, we have decided to decrease the fair value of the various instruments, as outlined below. These adjustments vary based on considerations of seniority and claims to underlying cashflows within the securitised structures.

Vunani Fund Managers is in the process of appointing an independent valuator. This step, coupled with any new information that emerges, may necessitate a review of the above adjustments. Furthermore, VFM maintains regular meetings with the issuer, underlying service agent, and other debtholders. This approach ensures that we stay informed and can adapt strategies as the situation evolves.

February 2024 – Communication From Vunani Fund Managers – Exposure to Bridge Taxi Finance 6 and 8 SPVs (Special Purpose Vehicles)

Mi-Plan

1st Floor, Mariendahl House Newlands on Main Newlands

7700

Cape Town

26 February 2024

Attention: Anton Turpin

Re: Instruments exposed to Bridge Taxi 6 and 8 SPVs

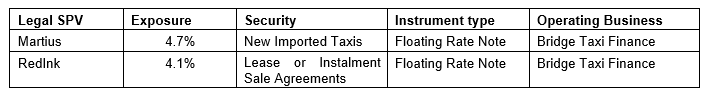

Vunani Fund Managers would like to advise you of specific instruments in your clients’ investment portfolio that have been impacted by recent economic challenges in South Africa. The investments are in the taxi financing space. The investment instruments are in the Redink Rentals (RF) Limited (“Redink”) and Martius (RF) Limited (“Martius“) Note Programmes. Within the Programmes, client portfolios have exposure to two special purpose vehicles linked to Bridge Taxi Finance No. 8 (RF) (Pty) Ltd (“BTF 8”) and Bridge Taxi Finance No. 6 (RF) (Pty) Ltd (“BTF 6”). As the names of the SPVs suggest, these are ring fenced vehicles. Martius funds the importation, insurance in transit, and licensing of new taxis. Redink finances the securitisation of debt once the taxis have been sold and leased to owners. The Martius notes reside in BTF 8 whilst the Redink notes reside in BTF 6.

The exposure to each instrument as a percentage of the MiPlan IP Enhanced Income Fund at inception of the Retention Fund / side-pocket is as follows:

| Portfolio | RED707 | RED706 | MAR03B | MAR02B |

| MiPlan IP Enhanced Income Fund* | 2.78% | 1.19% | 0.29% | 4.45% |

*Reflects percentages as at 15 Feb 2024 prior to instruments migrating to the Retention Fund / side-pocket

Background

Bridge Taxi Finance, established in 2013, provides development credit finance to South African entrepreneurs in the minibus taxi industry, empowering them to provide their clients with safe, secure, and reliable transport. Approximately 70% of all commuter journeys in South Africa are made using taxis. The critical shortage of minibus taxis in South Africa and high positive social impact of improving public transportation for millions of South Africans, while providing accessible finance to local entrepreneurs provided a compelling investment case, which has performed very well for our clients since our first investment in June 2018.

Economic strain

The prevailing credit environment, slowdown in new vehicle sales, elevated petrol prices and recent unfortunate passing on 4 January 2024 of Martin Bezuidenhout, the founder and CEO of Bridge Taxi Finance and its operating company, Mokoro, has placed significant pressure on the business. Although your exposure is to direct ownership of vehicles and leases, the business strains at Mokoro (collections and repossession agent) have had an impact.

Vunani Fund Manager’s plan of action

Rest assured, we are working tirelessly with the issuer, management, and other co-investors to understand the underlying cash flows and the liquidity pressures facing the business. Our dedicated efforts are aimed at effectively addressing the current pressures on the business to hasten and increase collection levels at Mokoro. These efforts include weekly and sometimes daily lender meetings with management that are driving towards enhancing the granularity of reporting and committing resources to the correct areas of the business. Our priority is to navigate these challenges prudently while striving to uphold the integrity of our investment portfolios. Vunani Fund Managers holds notes in transactions 6 and 8, which are not currently in default. That notwithstanding, poor collection levels by Mokoro led to a decision by our Credit Committee and EXCO to suspend interest accruals on the respective instruments in client portfolios as a precautionary measure. Accordingly, interest will be accounted for only on receipt.

Side-pockets / Retention Fund

Vunani Fund Managers manages collective investment schemes (“CIS”) on behalf of certain clients, and, for these portfolios, a decision was taken in conjunction with the trustees of these schemes, and approval of the Financial Sector Conduct Authority, to create a retention portfolio to avoid potentially prejudicing incoming investors. The retention portfolio will be managed separately, the ultimate objective being to ensure that outstanding interest payments and capital redemptions are recovered and paid to investors exposed to the instruments at the date of the implementation of the retention portfolio. Each investor receives a participatory interest proportionate to the investors investment in the CIS they hold. This ensures fair treatment of all clients. Furthermore, no investment management fees will be levied on the retention portfolio.

Committed to our clients’ best interest

Vunani Fund Managers has a good recovery track record in cases where investments have had similar challenges, an experience which will be brought to bear in this case. Our commitment to transparency remains unwavering, and we are dedicated to keeping you informed of any significant developments in the resolution of this matter. Open lines of communication will be maintained to ensure that you are kept abreast of all critical updates.

Your sincerely,

Aadila Manjra

Acting Head of Business Development

First Floor

5 Cavendish Street, Claremont, 7708

PO Box 44586, Claremont, 7735

T +27 21 670 4900

F +27 21 683 5788

W vunanifm.co.za

Executive Directors: S Narker, M Savage

Non-Executive Directors: T Bonoyi, N Chonco (Chairman), E Dube, L Mtembu

Reg No: 1999/015894/07 Vunani Fund Managers (Pty) Ltd is an authorised financial services provider. FSP License No.: 608

Click below to view this as a PDF

February 2024 – Q&A – MiPlan IP Enhanced Income Retention Fund

Purpose of this Q&A

This Q&A is provided to help investors understand the specifics of the MiPlan IP Enhanced Income Retention Fund (“the Retention Fund”). Further information will be added hereto from time to time as and when such information becomes available. As such, this Q&A must not be considered as exhaustive. If investors have further questions or require additional information, they are urged to contact their financial advisor, MiPlan or the IPMC Client Services Team on the respective contact details below.

Important Notice

IPMC and MiPlan are not privy to any information regarding Martius (RF) Limited (“Martius”), Redink Rentals (RF) Limited (“Redink”) or Bridge Taxi Finance Proprietary Limited (“BTF”) that is not published by those entities, or in the public domain. All information regarding Martius, Redink and BTF has been obtained through the internet or from Vunani Fund Managers Proprietary Limited (“Vunani”).

Respective Entities

- MiPlan established the MiPlan IP Enhanced Income Fund, providing it with its name and initial capital (“Main Fund”).

- IPMC is the manager of the Collective Investment Scheme, including the Main Fund.

- Vunani is the investment manager of the Main Fund. Rowan Williams-Short of Vunani is the portfolio manager of the Main Fund.

- Martius is a ring-fenced special purpose vehicle, incorporated for the sole purpose of holding and issuing notes to secured creditors under its Issuer Programme to fund the acquisition of and/or investment in participating assets in respect of a transaction.

- Redink is a remote special purpose vehicle, with restricted operating activities, incorporated to purchase eligible assets with funds raised directly through the issuance of debt instruments.

- BTF operates in the commuter sector, acquiring and/or importing minibus taxis, which it then sells under instalment sale agreements to taxi operators.

- Redinc Capital Proprietary Limited is the arranger for each of Martius and Redink notes issues.

Which assets were side-pocketed?

The Main Fund invested in two notes issued by Martius, namely the MAR02B, issued 23/09/2022, and the MAR03B, issued17/03/2023, and two notes issued by Redink, namely RED706, issued 17/04/2023, and RED707, issued 17/04/2023. These are the assets that were side-pocketed. Martius and RedInk are two separate legal entities, each with specific assets backing each of their structures. The common factor across both special purpose vehicles is the underlying business operation of BTF. The table below summarises the side-pocketed assets:

What is the structure and nature of the transactions giving rise to the side-pocketed assets?

The structures are extremely complex, but can be summarised and simplified, for illustrative purposes, as follows:

- Step One: Vunani, in its discretion, subscribes for the notes in Martius and Redink on behalf of and for the Main Fund.

- Step Two: Funds obtained by Martius are used to import taxis. Funds obtained by Redink are used to buy taxis and then lease them.

What process was followed in making the investment?

The fixed interest team of Vunani, as investment manager, sourced, analysed, assessed and made the investment in accordance the Main Fund’s Deed and investment policy.

Why was the Retention Fund necessary?

As indicated in the Q&A explaining retention funds, where an asset cannot be valued accurately the risk arises that the price for subscriptions or redemptions will not be accurately reflected, potentially resulting in concentrative or dilutive effects for investors entering or exiting a fund. A retention fund avoids the scenario in which remaining investors are further exposed to these assets when or if other investors redeem from a fund. In addition, it avoids new investors being exposed to these assets when their valuation is uncertain. Accordingly, the creation of the Retention Fund was deemed necessary to protect both existing and new investors, in the Main Fund, as it addresses the uncertainty created by the publication of the two SENS Announcements regarding the assets which have been side-pocketed and are the subject of the Retention Fund, allowing the fund manager the required time to investigate the best course of action to preserve long term value, realise the side-pocketed assets or claim under any security, where applicable.

What event occurred to require that these assets be side-pocketed?

On 31 January 2024, each of Martius and Redink published a SENS announcement drawing the attention of the holders of the side-pocketed assets that an event of default had occurred under a Revolving Credit Facility Agreement and Revolving Loan Facility Agreement, respectively, as well as a service default in respect of their Servicing Agreements. Holders and potential investors were also advised to exercise caution when dealing in the side-pocketed assets. It was further established that there had been only a partial settlement of interest owing to subordinated debt holders. A preliminary assessment by Vunani indicated that the credit risk of the business and its associated debt instruments had increased significantly and remained elevated.

According to Vunani’s preliminary investigation and assessment, the underlying cause of the defaults was, amongst others, increased consumer distress due to heightened interest rates and inflation, and the prevailing credit environment, which placed significant pressure on BTF’s clients and their ability to meet their debt obligations. While Vunani has been in contact with BTF, other debtholders and shareholders, it is apparent that more time would be required to understand the challenges facing the BTF business, and the potential effects and consequences thereof on the side-pocketed assets. As a result of this uncertainty it became necessary to be prudent and cautious, to protect the interests of both existing and new investors, especially given the lack of liquidity in trading and dealing in the side-pocketed assets.

When can investors redeem the side-pocketed assets?

Redemptions are not permitted from the Retention Fund until such time as the side-pocketed assets are able to be realised or their valuation confirmed. Although the instruments are still pricing in accordance with the normal process for listed instruments, the portfolio manager is of the view that:

- the valuation cannot currently be accurately determined; and

- the liquidity / tradability of the notes or side-pocketed assets is uncertain at this time.

The portfolio manager will continue to actively engage with the issuers, the underlying business, and other stakeholders, to establish the best course of action to support the business, in the interest of long-term value maximisation. There is no defined timeline at this stage. Once the process is concluded, and dependant on the outcome, the Manager would likely collapse the Retention Fund and transfer the side-pocketed assets back to the Main Fund for the benefit of the investors in the Retention Fund or redeem the proceeds of the realised side-pocketed assets to the investors in the Retention Fund.

Contact details

IPMC Client Services Team : clientservices@ipmc.co.za / MiPlan : info@miplan.co.za.

Click below to view this as a PDF

February 2024 – Notice to MiPlan IP Enhanced Income Investors – Retention Fund Update

16 February 2024

This notice updates and replaces the previous notice of 15 February 2024.

To: All MiPlan IP Enhanced Income Fund Investors Dear Investor

NOTICE TO MIPLAN IP ENHANCED INCOME FUND INVESTORS RE THE SIDEPOCKETING OF CERTAIN NOTES INTO THE NEWLY CREATED MIPLAN IP ENHANCED INCOME RETENTION FUND

No action is required, but this communication contains important information for investors in the MiPlan IP Enhanced Income Fund.

The recent SENS announcements regarding the Mar 02B & Mar 03B and Red 706 & Red 707 notes held in the Fund have created uncertainty due to the lack of published information. As an initial precautionary measure, interest accruals were suspended on these notes as of 9 February 2024.

In order to allow for adequate time for analysis, understanding, stakeholder engagement, and solution development, with the long-term preservation of value and the best interest of investors, a decision has been taken to side-pocket these notes into a separate portfolio, named the “MiPlan IP Enhanced Income Retention Fund”. Investors will be issued with units to the equivalent value in this new retention portfolio, but will not be able to redeem their units from this portfolio. These notes represent approximately 8.8% of the Fund’s assets, at time of carve out. This option was only implemented after consultation with the Fund’s investment manager, its Trustee and the approval of the Financial Sector Conduct Authority. The benefit of this option is that the uncertainty concerning the valuation of the notes, the payment of future interest coupons and capital repayments is transferred from the MiPlan IP Enhanced Income Fund and contained within or confined to the new retention portfolio. The other investments in the MiPlan IP Enhanced Income Fund will continue as normal.

As at and from 16 February 2024, investors will receive a statement reflecting their units in both the MiPlan IP Enhanced Income Fund and the new retention portfolio. No investment management fees will be charged on the MiPlan IP Enhanced Income Retention Fund, unless circumstances in the future determine or require otherwise. Investors will be kept informed as and when more information becomes available. In the interim, any queries may be addressed to your financial advisor, the IPMC Client Services Team on clientservices@ipmc.co.za or MiPlan on info@miplan.co.za.A Question and Answer support document will be posted on the IPMC and MiPlan websites to assist investors in an understanding of the industry use of side pockets and retention portfolios.

Investors are thanked for their understanding and support.

Yours sincerely

Brett Paton | IP Management Company (RF) Proprietary Limited

Anton Turpin | MiPlan Proprietary Limited

Click below to view this as a PDF

February 2024 – Q and A Sidepocket Retention Funds

Purpose of this Q&A

This Q&A is provided to help investors understand retention funds, often referred to as “side pocket funds”. If investors have further questions or require additional information, investors are urged to contact their financial advisor, MiPlan or the IPMC Client Services Team on the respective contact details below.

What are retention funds and how do they work?

Side-pocketing is the process of separating and transferring an asset out of the main fund and allocating it to a separate newly created retention (side pocket) fund. This may be as a result of the asset being illiquid or its value not being readily, prudently, accurately or realistically determinable in the prevailing circumstances. A side-pocketed asset of the retention fund is not lost to investors, just transferred to the newly created retention (side pocket) fund – this side-pocketed asset or its value is not written off or written down, just ring-fenced in the newly created retention (side pocket) fund. Adding or aggregating the two funds together, that is the main fund and the newly created retention (side pocket) fund, means investors retain 100% of their investment. The main fund will continue to trade, receive contributions, pay out withdrawals and earn interest as it always has. Side-pocketing is not considered a reduction in value.

Why are retention funds necessary?

Where an asset is or may be affected, it could affect the ability of a fund to realise the asset, at all or at a reasonable price, in order to meet investor redemptions. Where an asset cannot be valued accurately the risk arises that prices for subscriptions or redemptions will not be accurately reflected resulting concentrative or dilutive effects for investors entering or exiting the fund. The creation of a side pocket allows for the continued issue and redemption of units in the liquid pool while reducing the foregoing pricing risk. Accordingly, the main aim and objective of side-pocketing is the protection of investors, both existing and new, whether exiting or investing in the main fund. Existing investors will not be prejudiced by other investors making withdrawals or redemptions and leaving the remaining investors with a greater share of the side-pocketed assets. New investments will not be exposed to or have any interest in any of the side-pocketed assets.

Can investors redeem their units in the newly created retention (side pocket) fund?

Investors will not be able to redeem their units in the newly created retention (side pocket) fund until or unless circumstances change, such as the side-pocketed assets being realised.

Do side pockets come with FSCA Approval?

Side pockets or retention funds are and must be approved by the Financial Sector Conduct Authority. This is in line with international best practice and the Collective Investments Schemes Control Act, 2002 (Act No. 45 of 2002), as amended, and the various Board Notices published thereunder from time to time.

Contact details

IPMC Client Services Team: clientservices@ipmc.co.za / MiPlan : info@miplan.co.za

Click below to view this as a PDF

February 2024 – Client Communique to MiPlan IP Enhanced Income Investors from Vunani Fund Managers

Pursuant to the recent Martius and Redink SENS announcements regarding the notes Mar 02B & Mar 03B and Red 706 & Red 707, respectively, MiPlan has been advised by the portfolio manager, Vunani Fund Managers, in consultation with the fund’s trustee, that it would be in the best interest of all investors, that interest on these notes should not be accrued in the fund pending further consideration. This was actioned by the fund’s administrators, effective 9 February 2024.

Further to the above notice, the fund’s portfolio manager, Vunani Fund Managers, has provided the following information:

February 2024 – Notice to MiPlan IP Enhanced Income Fund Investors

Pursuant to the recent Martius and Redink SENS announcements regarding the notes Mar 02B & Mar 03B and Red 706 & Red 707, respectively, MiPlan has been advised by the portfolio manager, Vunani Fund Managers, in consultation with the fund’s trustees, that it would be in the best interest of all investors, that interest on these notes should not be accrued in the fund pending further consideration. This was actioned by the fund’s administrators, effective 9 February 2024. A further announcement, with more detailed information, is currently being prepared by the fund’s aforestated portfolio manager.

MiPlan – 9 February 2024