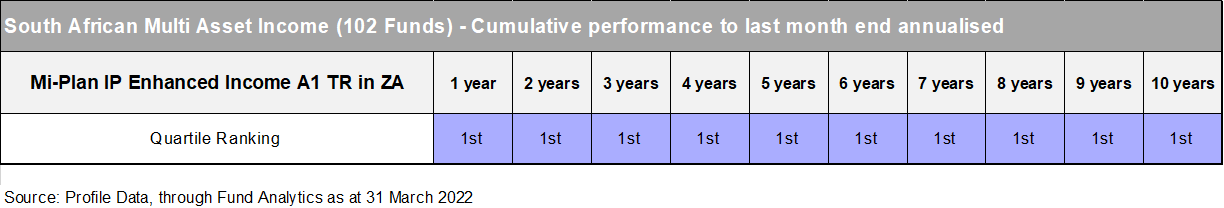

On 31st March 2022, the Mi-Plan IP Enhanced Income Fund attained its 10th anniversary, and what better way to celebrate with our investors than to announce that the fund is in the 1st quartile over every period from 1 year to 10 years as set out below.

The fund has been managed by Rowan Williams-Short throughout this period. At Mi-Plan, we seek to appoint “best in class” asset managers for each of our funds, striving to match each manager’s unique skill to a fund mandate that is suited to this skill. The above achievement is therefore very satisfying for Mi-Plan and all our clients, and our thanks and congratulations go to Rowan.

As of the 31 March 2022, the fund has a yield-to-maturity of 7.75%, a running (income) yield of 8.06%, a modified duration of 1.13 and a spread duration of 1.25.

Upon being asked for comment on the current positioning of the fund, Rowan noted:

“Never before in my 33-year career has the direction of the SARB’s short-term interest rate trajectory been clearer: we will definitely have more increases in the repo rate and hence in each of the JIBAR rates. This means that the yield on some 60% of the portfolio will increase (without capital losses from that source, as would be the case in bonds) over the year. It is my belief that bond yields, as usual, adequately price in the repo rate increases.”